A Guide to Proactive Medical Coding Audits

Introduction

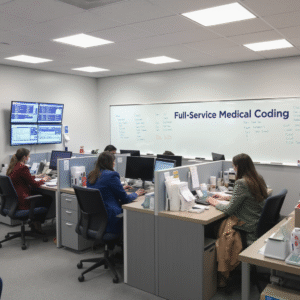

Medical Coding

Medical Coding

Medical coding audits are systematic reviews of medical records and coding practices designed to ensure accuracy, compliance, and optimal reimbursement. Rather than waiting for external audits or compliance issues to arise, proactive medical coding audits allow healthcare organizations to identify and address potential problems before they become costly violations. This comprehensive guide explores the essential components of implementing effective proactive auditing programs that protect revenue cycles while maintaining regulatory compliance.

Understanding Medical Coding Audits

Medical coding audits involve the systematic examination of patient medical records to verify that assigned diagnostic and procedural codes accurately reflect the documentation provided by healthcare providers. These audits serve multiple purposes: ensuring compliance with federal and state regulations, optimizing revenue cycle management, identifying educational opportunities for coding staff, and reducing the risk of overpayments that could trigger government audits or penalties.

The audit process typically involves reviewing a representative sample of coded medical records, comparing the assigned codes against the supporting documentation, and identifying discrepancies or areas for improvement. Auditors examine whether the codes accurately represent the services provided, meet medical necessity requirements, and comply with current coding guidelines and regulations.

Benefits of Proactive Auditing

Implementing proactive medical coding audits offers numerous advantages over reactive approaches. Financial benefits include identifying undercoding that results in lost revenue, preventing overcoding that could lead to costly repayments and penalties, and optimizing the overall revenue cycle. From a compliance perspective, proactive audits help organizations stay ahead of regulatory changes, demonstrate good faith efforts to maintain compliance, and reduce the likelihood of triggering government audits.

Operational benefits extend to improving coding accuracy and consistency across the organization, identifying training needs for coding and clinical staff, enhancing documentation quality, and strengthening internal controls. Additionally, proactive auditing builds confidence among stakeholders, including administrators, physicians, and board members, by demonstrating the organization’s commitment to ethical billing practices and regulatory compliance.

Key Components of an Effective Audit Program

A successful proactive auditing program requires several essential components working together systematically. Leadership support and commitment provide the foundation, ensuring adequate resources and organizational buy-in. Clear policies and procedures establish consistent audit methodologies and reporting standards throughout the organization.

Qualified audit personnel represent another critical component, whether internal staff with appropriate credentials and training or external consultants with specialized expertise. Technology infrastructure supports efficient audit processes through coding software, audit management systems, and data analytics tools that can identify patterns and trends requiring attention.

Regular audit scheduling ensures consistent monitoring rather than sporadic reviews, while comprehensive reporting mechanisms communicate findings effectively to relevant stakeholders. Finally, corrective action protocols establish clear processes for addressing identified issues and preventing recurrence.

Developing Your Audit Strategy

Creating an effective audit strategy begins with conducting a thorough risk assessment to identify areas of greatest vulnerability within your organization. High-risk areas might include services with complex coding requirements, procedures with frequent regulation changes, or departments with recent staff turnover or training gaps.

Establish clear audit objectives that align with organizational goals, whether focusing on compliance, revenue optimization, or quality improvement. Determine the appropriate audit frequency and sample sizes based on risk levels, regulatory requirements, and available resources. Higher-risk areas may warrant monthly audits, while lower-risk services might be reviewed quarterly or annually.

Develop standardized audit tools and worksheets that ensure consistency across different auditors and time periods. These tools should include relevant coding guidelines, compliance requirements, and documentation standards specific to your organization’s services and patient population.

Types of Medical Coding Audits

Several different types of audits serve distinct purposes within a comprehensive auditing program. Prospective audits occur before claims submission, allowing organizations to identify and correct errors before billing. While resource-intensive, prospective audits provide the greatest protection against compliance violations and claim denials.

Concurrent audits take place during the patient’s episode of care, enabling real-time corrections and educational opportunities. These audits are particularly valuable for complex cases or when implementing new procedures or coding guidelines.

Retrospective audits review completed cases after billing has occurred, making them the most common type of proactive audit. These audits can identify systemic issues, trending problems, and opportunities for process improvement.

Focused audits target specific services, providers, or coding categories based on identified risks or concerns. These might include audits of evaluation and management services, surgical procedures, or specific diagnosis categories that have shown higher error rates.

Audit Methodology and Best Practices

Effective audit methodology begins with proper sample selection using statistically valid methods to ensure representative results. Random sampling provides the most unbiased approach, while stratified sampling allows focus on specific risk areas or service lines. Sample sizes should be adequate to draw meaningful conclusions while remaining manageable from a resource perspective.

Documentation review forms the core of the audit process, requiring auditors to carefully examine medical records against assigned codes. This review should assess whether documentation supports the assigned codes, meets medical necessity requirements, and complies with current coding guidelines and payer-specific requirements.

Maintain detailed audit worksheets that document findings, rationale for any recommended changes, and supporting references to coding guidelines or regulations. This documentation proves essential for educational purposes, trending analysis, and potential appeals processes.

Common Areas of Focus

Certain areas consistently require attention in medical coding audits due to their complexity or frequent regulatory changes. Evaluation and management services represent a common focus area, as these codes require careful assessment of documentation supporting the level of service billed. Key elements include history, examination, medical decision-making complexity, and time when applicable.

Surgical coding presents challenges related to bundling rules, modifier usage, and proper reporting of multiple procedures. Auditors must verify that surgical codes accurately reflect the procedures performed and that modifiers are appropriately applied.

Diagnosis coding requires attention to specificity, sequencing, and supporting documentation. With the ongoing evolution of ICD-10-CM guidelines, regular review ensures compliance with current requirements and optimal specificity.

Emergency department coding presents unique challenges related to acuity levels, observation services, and critical care documentation. These high-volume, complex services often benefit from frequent audit attention.

Technology and Tools

Modern audit programs benefit significantly from technology solutions that enhance efficiency and effectiveness. Audit management software can streamline the audit process by organizing cases, tracking findings, and generating reports. These systems often include workflow management features that ensure consistent follow-up on identified issues.

Data analytics tools enable organizations to identify patterns and trends that might indicate systematic problems or opportunities for improvement. These tools can analyze coding patterns, denial rates, and audit findings to prioritize future audit activities.

Computer-assisted coding systems can support audit activities by flagging potential coding errors or inconsistencies for human review. While not replacing human expertise, these tools can enhance audit efficiency and consistency.

Staff Training and Education

Successful proactive auditing programs require well-trained staff capable of conducting thorough, accurate audits. Internal auditors need comprehensive training in coding guidelines, regulatory requirements, and audit methodology. This training should be ongoing to keep pace with evolving requirements and best practices.

Clinical documentation improvement education helps providers understand how their documentation impacts coding accuracy and compliance. Regular training sessions can address common documentation deficiencies identified through audit activities.

Coding staff benefit from audit findings through targeted education that addresses identified knowledge gaps or process improvements. This creates a continuous improvement cycle that enhances overall coding accuracy.

Reporting and Communication

Effective audit programs include robust reporting mechanisms that communicate findings clearly to relevant stakeholders. Executive summaries provide high-level overviews for administrators and board members, highlighting key findings, trends, and recommended actions.

Detailed audit reports offer comprehensive findings for compliance officers, coding managers, and clinical leaders who need specific information to implement improvements. These reports should include clear recommendations, supporting documentation, and timelines for corrective actions.

Regular trending reports track audit findings over time, enabling organizations to monitor improvement efforts and identify emerging issues. These reports prove valuable for strategic planning and resource allocation decisions.

Corrective Action and Follow-up

Identifying problems through auditing represents only the first step in an effective program. Robust corrective action processes ensure that identified issues are addressed promptly and effectively. This includes immediate correction of individual cases when necessary, as well as systematic changes to prevent recurrence.

Educational interventions might include targeted training for specific providers or coding staff, updated policies and procedures, or enhanced documentation templates. Process improvements could involve workflow changes, additional review checkpoints, or enhanced quality assurance measures.

Follow-up audits verify that corrective actions have been implemented effectively and are achieving desired results. This creates a continuous improvement cycle that enhances overall program effectiveness.

Measuring Success

Successful audit programs include clear metrics for measuring effectiveness and demonstrating value to organizational leadership. Financial metrics might include recovered revenue from identified undercoding, prevented overpayments, or reduced claim denial rates.

Quality metrics could track coding accuracy rates, documentation improvement scores, or compliance indicator trends. Operational metrics might measure audit completion rates, finding implementation timeliness, or staff satisfaction with audit processes.

Regular program evaluation ensures that audit activities remain aligned with organizational priorities and continue to provide optimal value for invested resources.

Conclusion

Proactive medical coding audits represent a critical component of effective healthcare revenue cycle management and compliance programs. By implementing systematic, well-designed audit processes, healthcare organizations can identify and address potential issues before they become costly compliance violations or significant revenue losses.

Success requires commitment from organizational leadership, qualified audit personnel, appropriate technology tools, and robust processes for corrective action and follow-up. When implemented effectively, proactive auditing programs protect organizational revenue, ensure regulatory compliance, and support continuous improvement in coding accuracy and documentation quality.

The investment in proactive auditing typically pays significant dividends through improved revenue cycle performance, reduced compliance risks, and enhanced operational efficiency. As healthcare regulations continue to evolve and payer scrutiny intensifies, organizations that implement comprehensive proactive auditing programs position themselves for sustained success in an increasingly complex environment.