What is Revenue Cycle Management (RCM) in Healthcare?

Revenue Cycle Management

Revenue Cycle Management

In the complex world of healthcare, managing finances effectively is crucial for the sustainability and growth of medical practices, hospitals, and healthcare systems. Revenue Cycle Management (RCM) serves as the financial backbone of healthcare organizations, ensuring that providers receive proper compensation for the services they deliver to patients. Understanding RCM is essential for healthcare administrators, medical professionals, and anyone involved in the business side of healthcare delivery.

Defining Revenue Cycle Management

Revenue Cycle Management is a comprehensive financial process that healthcare organizations use to track patient care episodes from registration and appointment scheduling to the final payment of a balance. It encompasses all administrative and clinical functions that contribute to the capture, management, and collection of patient service revenue. The revenue cycle begins when a patient makes an appointment and ends when the healthcare provider has collected all payments for services rendered, including payments from insurance companies and patients themselves.

The primary goal of RCM is to identify and address any barriers to efficient and timely payment, ultimately maximizing revenue while minimizing costs associated with billing and collections. Effective RCM ensures that healthcare providers can maintain financial stability while focusing on their primary mission of delivering quality patient care.

The Healthcare Revenue Cycle Process

The revenue cycle in healthcare is a multi-step process that involves various departments and stakeholders working together to ensure proper billing and payment collection. Understanding each phase is crucial for optimizing the entire cycle.

Pre-Service Activities

The revenue cycle begins before the patient even receives medical care. Pre-service activities include patient registration, insurance verification, and pre-authorization processes. During registration, accurate demographic and insurance information must be collected to prevent billing delays later in the cycle. Insurance verification ensures that coverage is active and determines the patient’s financial responsibility, including copayments, deductibles, and coinsurance amounts.

Pre-authorization is often required for certain procedures, tests, or treatments. This step involves obtaining approval from insurance companies before services are rendered, preventing claim denials and ensuring coverage. Financial counseling may also occur during this phase, helping patients understand their financial obligations and available payment options.

Service Delivery and Documentation

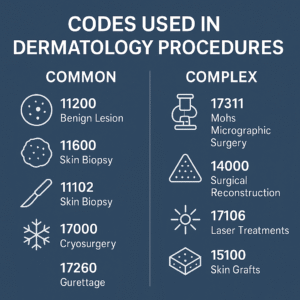

Once the patient receives care, proper documentation becomes critical. Healthcare providers must accurately document all services, procedures, diagnoses, and treatments provided during the patient encounter. This documentation serves as the foundation for medical coding, which translates medical services into standardized codes used for billing purposes.

Medical coding involves assigning specific codes to diagnoses (ICD-10 codes) and procedures (CPT codes) based on the provider’s documentation. Accurate coding is essential for proper reimbursement and compliance with regulatory requirements. Any errors in coding can lead to claim denials, underpayments, or compliance issues.

Claims Submission and Processing

After coding is complete, claims are submitted to insurance companies or government payers such as Medicare and Medicaid. Claims must be submitted in the correct format and include all necessary information to avoid rejections or denials. Electronic claims submission has become the standard, as it reduces processing time and minimizes errors compared to paper claims.

Once submitted, claims go through various edits and reviews by payers. Clean claims that contain no errors are typically processed quickly, while claims with issues may be rejected or denied, requiring correction and resubmission.

Payment Posting and Reconciliation

When payments are received from insurance companies, they must be accurately posted to patient accounts. This process involves matching payments to specific claims and identifying any variances between expected and actual payments. Explanation of Benefits (EOB) statements provide details about how claims were processed and what amounts were paid or adjusted.

Any discrepancies must be investigated and resolved promptly. This may involve appealing denied claims, correcting billing errors, or following up with payers for additional information.

Patient Billing and Collections

After insurance payments are processed, patients are billed for their remaining financial responsibility, including deductibles, copayments, and any services not covered by insurance. Patient statements should be clear and easy to understand, with detailed explanations of charges and payment options.

Collection activities may include sending multiple statements, making phone calls, and offering payment plans to help patients manage their financial obligations. Some organizations work with third-party collection agencies for accounts that remain unpaid after internal collection efforts.

Key Components of Effective RCM

Successful revenue cycle management relies on several critical components working together seamlessly. Technology plays a vital role, with electronic health records (EHR) systems, practice management software, and specialized RCM platforms helping to automate processes and reduce errors. These systems can flag potential issues, track claims status, and generate reports to monitor performance.

Staff training and education are equally important. Team members must understand their roles in the revenue cycle and stay current with changing regulations, coding requirements, and payer policies. Regular training helps maintain accuracy and efficiency throughout the process.

Quality assurance measures, including regular audits and performance monitoring, help identify areas for improvement and ensure compliance with regulatory requirements. Key performance indicators (KPIs) such as days in accounts receivable, first-pass claim acceptance rates, and collection percentages provide valuable insights into revenue cycle performance.

Benefits of Optimized RCM

Healthcare organizations that implement effective revenue cycle management strategies experience numerous benefits. Improved cash flow is perhaps the most immediate advantage, as optimized processes reduce the time between service delivery and payment collection. This enhanced cash flow provides greater financial stability and flexibility for healthcare organizations.

Reduced administrative costs result from increased efficiency and automation. When processes are streamlined and errors are minimized, less time and resources are required for billing and collections activities. This allows staff to focus on other important tasks and reduces overall operational costs.

Enhanced patient satisfaction often accompanies improved RCM processes. When billing is accurate and transparent, patients have a better understanding of their financial obligations and experience fewer billing-related frustrations. Clear communication about costs and payment options also contributes to positive patient experiences.

Compliance with regulatory requirements is another significant benefit. Effective RCM systems help ensure that billing practices adhere to healthcare regulations, reducing the risk of audits, penalties, and legal issues. This is particularly important given the complex and ever-changing nature of healthcare regulations.

Common RCM Challenges

Despite its importance, revenue cycle management faces numerous challenges that can impact effectiveness. Claim denials remain a persistent problem, with various factors contributing to rejection rates. Common reasons for denials include coding errors, missing information, lack of pre-authorization, and eligibility issues. Each denied claim requires time and resources to resolve, increasing administrative costs and delaying payment collection.

The complexity of insurance plans and payer requirements creates additional challenges. With numerous insurance companies, each having different policies, coverage criteria, and billing requirements, staying compliant with all payer rules can be overwhelming. Frequent changes to these requirements further complicate the process.

Technology integration issues can also hinder RCM effectiveness. When different systems don’t communicate properly, data may be duplicated or lost, leading to errors and inefficiencies. Ensuring that all technology platforms work together seamlessly requires ongoing attention and investment.

Staffing challenges, including high turnover rates and the need for specialized knowledge, can impact RCM performance. Training new employees takes time and resources, and turnover can disrupt established processes and relationships.

Future Trends in Healthcare RCM

The healthcare revenue cycle management landscape continues to evolve, driven by technological advances and changing industry dynamics. Artificial intelligence and machine learning are increasingly being used to automate routine tasks, predict claim outcomes, and identify patterns that can improve efficiency. These technologies can help reduce errors, speed up processes, and provide valuable insights for decision-making.

Patient engagement tools are becoming more sophisticated, offering online portals, mobile apps, and digital payment options that make it easier for patients to understand and pay their bills. These tools can improve patient satisfaction while reducing collection costs.

Value-based care models are changing how healthcare providers are reimbursed, shifting focus from volume to outcomes. This transition requires new approaches to revenue cycle management that can track and report on quality metrics and patient outcomes in addition to traditional billing activities.

Outsourcing and partnerships with specialized RCM companies are becoming more common as healthcare organizations seek to improve efficiency while focusing on their core mission of patient care. These partnerships can provide access to specialized expertise and advanced technology without requiring significant internal investments.

Conclusion

Revenue Cycle Management is a critical component of healthcare operations that directly impacts the financial health and sustainability of healthcare organizations. By understanding and optimizing the various phases of the revenue cycle, healthcare providers can improve cash flow, reduce costs, enhance patient satisfaction, and ensure compliance with regulatory requirements.

Success in RCM requires a combination of effective processes, appropriate technology, well-trained staff, and ongoing monitoring and improvement efforts. As the healthcare industry continues to evolve, organizations that invest in robust revenue cycle management capabilities will be better positioned to navigate challenges and capitalize on opportunities.

The future of healthcare RCM will likely involve greater automation, improved patient engagement, and new models of care delivery. Organizations that stay ahead of these trends and continuously adapt their revenue cycle management strategies will be best equipped to thrive in the dynamic healthcare environment.

Ultimately, effective revenue cycle management enables healthcare providers to maintain financial stability while focusing on their primary goal of delivering high-quality patient care. By treating RCM as a strategic priority rather than just an administrative function, healthcare organizations can create sustainable competitive advantages that benefit providers, patients, and the broader healthcare system.